Tax Planning for Small Businesses: A Comprehensive Guide

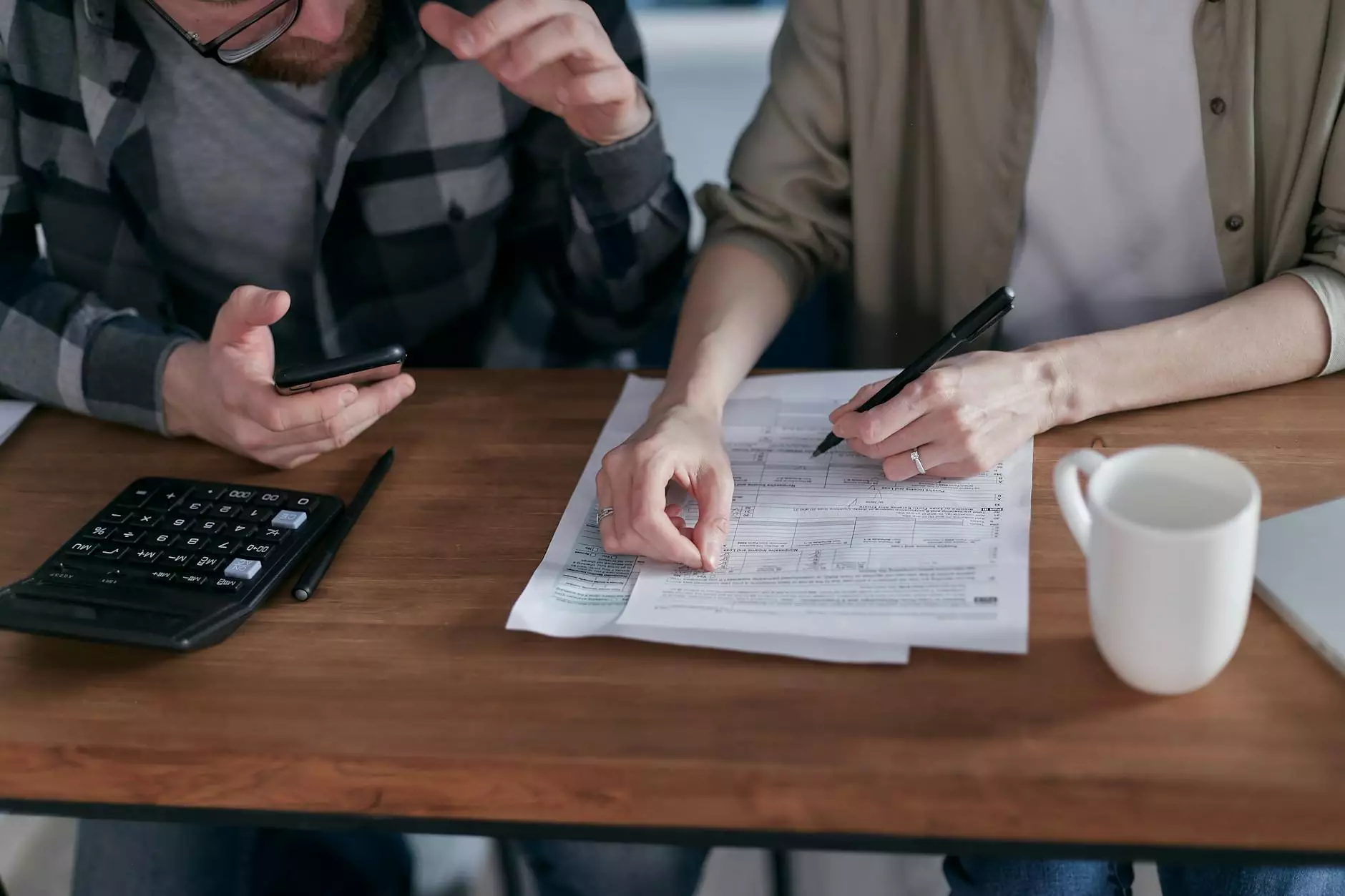

In the dynamic world of small business, tax planning is an essential element that can significantly impact profitability and sustainability. Understanding the nuances of tax regulations and implementing sound fiscal strategies can help small business owners not only save money but also enhance their growth potential. At Shandal CPA, we provide insights into effective tax planning methods tailored for small businesses.

What is Tax Planning?

Tax planning involves strategizing and organizing financial activities to minimize tax liability. It is not merely about filing taxes correctly; it includes preparing for future taxes by making informed decisions throughout the financial year. Effective tax planning can lead to substantial savings and improved cash flow.

Why is Tax Planning Essential for Small Businesses?

There are several key reasons why tax planning is particularly vital for small businesses:

- Maximizing Deductions: Small businesses have access to various deductions that they may not fully utilize without proper tax planning.

- Avoiding Overpayment: Through strategic planning, businesses can avoid overpaying their taxes and free up capital for reinvestment.

- Ensuring Compliance: Staying compliant with changing tax laws is challenging. Tax planning helps navigate these complexities.

- Future Growth Preparation: Effective tax strategies can prepare a business for future growth opportunities and investments.

The Basics of Tax Planning for Small Businesses

Tax planning can be broken down into several fundamental aspects that every small business owner should understand:

1. Understanding Business Structure

Your business structure (sole proprietorship, partnership, LLC, corporation) significantly influences your tax obligations. Each structure has different tax implications, and choosing the right one can lead to substantial savings.

2. Keeping Detailed Records

Maintaining accurate and detailed records enables precise tax calculations. This includes income, expenses, and business assets. Good record-keeping also assists with audits and ensures compliance.

3. Leveraging Deductions and Credits

Small businesses are eligible for various deductions such as operating expenses, employee wages, and capital expenditures. It's vital to identify and apply for all relevant deductions and credits available to minimize tax liabilities.

Common Tax Planning Strategies for Small Businesses

Implementing effective tax planning strategies can yield significant benefits for small businesses. Here are some common strategies that can be considered:

1. Timing Income and Expenses

By deferring income to the next tax year or accelerating expenses, business owners can manage their taxable income effectively. An understanding of the timing of revenue recognition and expenses can enhance tax outcomes.

2. Utilizing Retirement Plans

Establishing retirement plans like a SEP IRA or Solo 401(k) can provide significant tax benefits. Contributions to these plans are often tax-deductible, reducing overall taxable income.

3. Choosing the Right Accounting Method

Your accounting method, whether cash or accrual, affects your tax strategy. Each method has implications for when income and expenses are recognized, which can influence your overall tax position.

4. Employing Section 179 Deduction

The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment and software. This can be a powerful tool for reducing taxable income while investing in necessary business improvements.

5. Charitable Contributions

Small businesses can make charitable donations and deduct those amounts from their taxable income. This not only provides tax benefits but also enhances corporate social responsibility.

Tax Planning and Compliance

Staying compliant with federal, state, and local tax regulations is crucial for any business. Non-compliance can lead to significant penalties, audits, and legal issues. Here are some compliance tips:

- Stay Updated: Regularly review updates in tax laws and regulations that affect your business.

- Consult with Professionals: Engaging with a CPA or tax advisor can provide valuable insights and help ensure compliance.

- File Timely: Ensure that all tax returns and payments are filed on time to avoid penalties.

The Importance of Professional Help in Tax Planning

While understanding the basics of tax planning is vital, working with a professional can provide deep insights into optimizing your tax strategies. A tax advisor can offer tailored advice based on the unique circumstances of your business.

Here are some advantages of working with a tax professional:

- Expertise: Professionals stay current with tax laws and can suggest strategies that most small business owners might not be aware of.

- Time Savings: Tax planning can be complex and time-consuming. A professional can save you valuable time and reduce stress.

- Customized Solutions: A CPA can analyze your financial situation and suggest strategies tailored to your specific needs.

Year-Round Tax Planning

Many small business owners make the mistake of considering tax planning only during tax season. Year-round tax planning is crucial for maximizing savings and ensuring proper compliance. Regularly assessing your financial situation can lead to more informed decisions.

Monthly Financial Reviews

Conducting monthly reviews of your financials helps in tracking income, expenses, and tax obligations. This practice can aid in identifying potential tax planning opportunities.

Adjusting Estimated Taxes

If you anticipate changes in income or expenses, adjust your estimated tax payments accordingly. This proactive approach prevents underpayment penalties and better aligns your cash flow.

Conclusion

In conclusion, effective tax planning for small businesses is essential for financial success. By understanding the basics, implementing strategic practices, and seeking professional advice, small business owners can navigate the complexities of taxation and optimize their financial outcomes. At Shandal CPA, we’re committed to helping small businesses achieve their financial goals through expert tax planning. Start your journey towards successful tax management today!

Contact Us

For tailored guidance and comprehensive support in your tax planning, feel free to reach out through our website at shandalcpa.com and schedule a consultation.

tax planning small business